Checking Overview - Santander

Santander checking accounts

Santander Select® Checking

Get rewarded for your banking relationship with access to better benefits, discounts, and services that fuel your financial success and help provide a path to reach your goals.

Simply Right® Checking

A simple checking account with an easy-to-waive

Monthly Fee.

Santander® Essential Checking

When all you need are just the essentials with no surprises and the predictability you want with a low Monthly Fee.

Looking for an elevated banking experience with unique privileges and exclusive rates and benefits? Explore Santander® Private Client.

Client.

Compare Santander Checking Accounts

| Account | |||

| Debit Card | Santander Select World Debit Mastercard® | Santander Debit Mastercard® | Santander Debit Mastercard® |

| Monthly Fee* | $25 | $10 | $4 |

| How to waive the Monthly Fee* | Maintain a minimum combined balance of $25,000 in bank deposits (consumer and certain business products‡) and eligible investments§ held with Santander Investment Services. | Simply use the account each month. Any transaction1 (deposit, withdrawal, transfer, or payment) posted to the account. Additionally, the Monthly Fee is waived if any owner on the account is under 26 years of age. | The Monthly Fee is waived if any owner on the account is under 26 years of age or 65 years of age or over. |

| Interest earning? | Yes | No | No |

| Minimum opening deposit | $25 | $25 | $10 |

| ATM withdrawal fee (domestic non-Santander ATM)2 | $0 | $3 $2 if any owner on the account is under 26 years of age | $2.50 $2 if any owner on the account is under 26 years of age |

| Free Paperless Statements? | Yes | Yes | Yes |

| Paper Statement Fee | $0 | $3 | $2 |

| Mobile Banking and Online Banking? | Yes | Yes | Yes |

| Savings accounts benefits | Access to Santander Select® Money Market Savings. | Account waives Monthly Fee on Santander® Savings and Santander® Money Market Savings. | Account waives Monthly Fee on Santander® Savings and Santander® Money Market Savings. |

Bank anywhere, anytime

Manage your account whenever and wherever you want with our Mobile Banking App.

Download our

Mobile Banking App

Unlock on-the-go features with our highly-rated Mobile Banking App.

Scan QR code to open app. ![]()

Enroll in Santander

Online Banking

Manage your money securely by enrolling in Online Banking.

FAQs: Checking

In order to open an account online you will need a social security number, a US residential address (not a PO box), Funding account (routing & account number). To open an account in a branch, you will need two forms of Identification, including a Primary ID — which is a valid, government-issued photo ID (Driver’s License, Passport, State or Military ID), AND a Secondary ID — some examples include bank-issued ATM or debit cards, major credit cards, utility bills and birth certificates. You’ll also need your Social Security Number (Non-Residents can still apply without a SSN or can use their Individual Tax Reporting Number if they have one), a valid address and phone number, and an initial deposit.

Your new debit card will typically arrive in 5-7 business days. Your PIN is mailed separately from the debit card and both are mailed to the address on file. Once you receive your card, be sure to sign the back of the card. You can activate your debit card through our Mobile Banking App, at any Santander ATM, or by calling 877-726-0631.

If you open your account online, you will need to make an initial deposit. You may fund your account with a debit card, credit card, ACH transfers, check, or by depositing cash. Speak to a banker about the different ways to fund your account.

Yes. A Santander® Savings account or Santander® Money Market Savings account may be opened online in conjunction with any checking account opened online. Santander Select® Money Market Savings account requires a Santander® Select checking account and Santander® Private Client Money Market Savings account requires a Santander® Private Client checking account.

Our general policy is to make available $225 of all checks deposited on the next business day after the business day we receive your check deposits. The remainder, if any, of your deposit will usually be available on the second business day after the business day of deposit. In some cases, we may delay availability to withdraw funds beyond these periods. In such circumstances, we will send you a notice and the funds will generally be available on the sixth business day after the business day we receive your check deposits. Our full Funds Availability Policy can be found in the Personal Deposit Account Agreement or on our Funds Availability page.

Yes, you can open a joint account at a Santander Bank branch or online. To add a joint owner to your existing account, all parties must appear together at a Santander branch and will need to bring the following personal information: address, Social Security number, both government-issued ID and secondary form of identification.

Santander Mobile Banking App

Learn more about getting started with our highly-rated Mobile Banking App.

Read more

Direct Deposit

Learn more about how direct deposit works, and how to set up deposits directly to your checking account.

Read more

Getting Started with Online Banking

If you haven’t enrolled yet, read this easy step-by-step guide to get started.

Read more

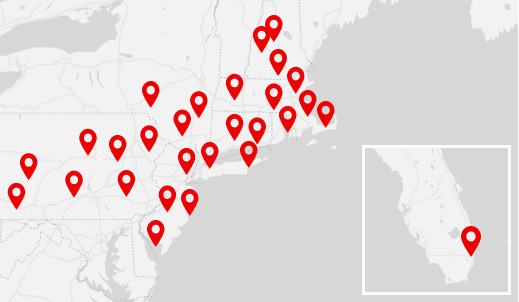

Find Us

Find Us

*Per service fee period.

‡Eligible business products include Business Checking, Savings, Money Market Savings, and Certificates of Deposit accounts, but exclude the following accounts: IOLTA, Bankruptcy, Brokered Deposits, Controlled Disbursement, Escrow, Government, and Union accounts.

§Eligible investments held with Santander Investment Services do not include the following: Annuities held at Mass Mutual, Allstate, Phoenix, Ohio National; Immediate Annuities or Annuities that have become annuitized; Mutual funds and 529 products not custodied by National Financial Services LLC; Insurance Products (with the exception of certain annuities held directly with a product sponsor).

1Excludes fees, rebates, or adjustments posted by Santander.

2Domestic ATMs are ATMs in the 50 United States, the District of Columbia, and Puerto Rico. ATM owner may charge a separate fee.

Securities and advisory services are offered through Santander Investment Services, a division of Santander Securities LLC. Santander Securities LLC is a registered broker-dealer, member FINRA and SIPC and a Registered Investment Adviser. Insurance is offered through Santander Securities LLC or its affiliates. Santander Investment Services is an affiliate of Santander Bank, N.A.

| INVESTMENT AND INSURANCE PRODUCTS ARE: | |||||

| NOT FDIC INSURED | NOT BANK GUARANTEED | MAY LOSE VALUE | |||

| NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | NOT A BANK DEPOSIT | ||||

Schedule one-on-one time with a banker.

Schedule one-on-one time with a banker. Equal Housing Lender - Member FDIC

Equal Housing Lender - Member FDIC